irs unveils federal income tax brackets for 2022

2022 tax brackets for single filers and married couples filing jointly tax rate taxable income single taxable income married filing jointly 10 up to 9950 up to 19900 12 9951 to 40525 19901 to 81050 22 40526 to 86375 81051 to 172750 24 86376 to 164925 172751 to 329850 32 164926 to 209425 329851 to. 9 rows As was the case and due to Trumps Tax Cuts and Jobs Acts the the personal exemption remained 0.

There S A Growing Interest In Wealth Taxes On The Super Rich

The federal government breaks your income up into chunks and you pay a different tax rate for each chunk.

. For example if youre a single tax filer who made 40000 in 2021 youll pay a 10 tax on the first 9950 you made and 12 of the amount ranging from 9950 to 40000 when you file in 2022. Families eligible for the expanded child tax credit who still havent received payments can still sign up to get the money through an updated portal unveiled by the White House on Wednesday designed to make the process even simpler. 12950 Heads of households.

As a result taxpayers with taxable income of 523600 or more for single filers and 628300 or more for married couples filing jointly will be subject to the top marginal income tax rate of 37. It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 7 rows Federal Tax Brackets 2022 for Income Taxes Filed by April 18 2022 Tax Bracket. This publication supplements Pub.

51 Agricultural Employers Tax Guide. Married filing jointly and earning 90000 22. 7 rows There are seven federal tax brackets for the 2021 tax year.

Discover Helpful Information and Resources on Taxes From AARP. Married couples filing jointly. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for married couples filing jointly 32 for incomes over 170050 340100 for married couples filing jointly 24 for incomes over 89075 178150 for married couples filing jointly.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Irs unveils federal income tax brackets for 2022. Ad Compare Your 2022 Tax Bracket vs.

19400 for tax year 2022. 25900 Single taxpayers and married individuals filing separately. Income limits for all tax brackets and filers will be modified for inflation in 2021 as stated in the tables below.

They dropped four percentage points and have a fairly significant amount of savings in taxes. The top marginal income tax rate of 37 percent will hit taxpayers with taxable. 1 day ago2022-05-11 1503.

The IRS also announced that the standard deduction for 2022 was increased to the following. 10 12 22 24 32 35 and. A listing of news releases published by the IRS in March 2022.

2022 Federal Income Tax Brackets And Rates In 2022 The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows Table 1. 77400 to 165000 22. November 12th 2021 under General News Law.

Thursday March 10 2022. Social security and Medicare tax for 2022. 15 Employers Tax Guide and Pub.

Your 2021 Tax Bracket to See Whats Been Adjusted. The rate of social security tax on taxable wages including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after March 31 2021 and before October 1 2021 is. Jan 18 2022 The rate is increased for each dependent child and also if the surviving spouse is housebound or in need of aid and attendance.

Single earning 190000 32. Single earning 100000 24. There are seven federal income tax rates in 2022.

To understand which 2018 tax bracket you are in here are a few examples.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

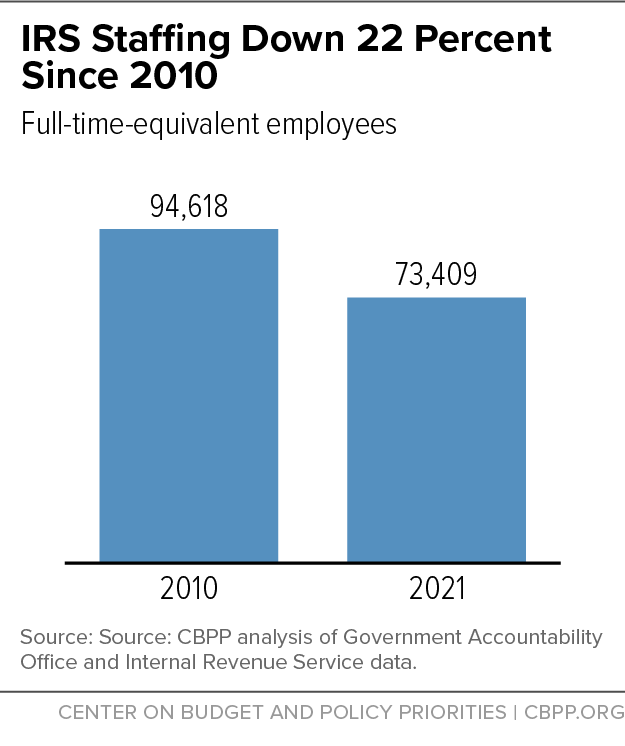

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

Tax Day 2022 Why Aren T Taxes Due On April 15 This Year

2020 Year End Tax Planning For Individuals

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Ny Has Third Highest Tax Rates In The Us Study Pix11

Irs Releases Updated Withholding Calculator And New Form W 4 Tax Pro Center Intuit

President Biden To Unveil New 20 Minimum Billionaire Tax In 2023 Budget Gobankingrates

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The Irs Has Sent Nearly 30 Million Refunds Here S The Average Payment

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces Standard Tax Deduction Increase For Tax Year 2022 To Adjust For Inflation

How To Do Your Taxes In 2022 Cbs News

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Irs Announces Standard Tax Deduction Increase For Tax Year 2022 To Adjust For Inflation

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

There S A Growing Interest In Wealth Taxes On The Super Rich

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More